In 2022, faced with major credit issues due to ballooning student loan payments and COVID related economic problems, the Department of Education began a program they dubbed “Fresh Start”. This program basically erased student loan defaults from millions of borrowers’ credit reports and moved them into a “current” status. The program also allowed borrowers to borrow again to continue their education, gave them affordable repayment options and halted all collection activity.

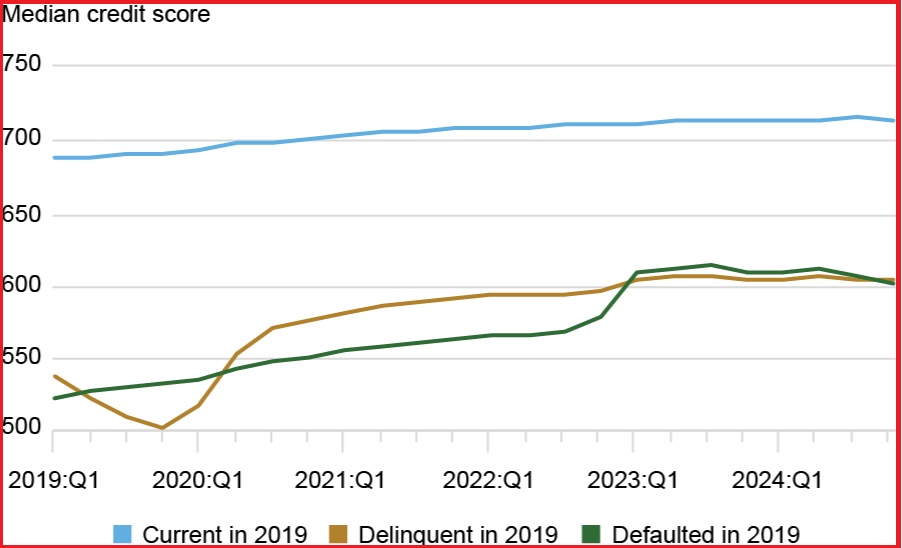

Borrowers had until the end of September 2024 to make arrangements for repayment. The pause in collection and reporting caused credit scores to jump more than 100 points for those who were currently late on payments and more than 70 for those who had loans in default. Since the pause ended, the Department of Education reported that 15.6% of all student loan debt is considered past due. Since the federal government considers 270 days of delinquency as a default, there stands to be a massive drop in credit scores on July 1.

People who have student loans which are late or are at risk of a default, but otherwise good credit, stand to see the biggest drop. The Department of Education predicts borrowers with otherwise good credit could see a 170 point drop in their credit scores once reporting goes back into effect at the beginning of July. Even for borrowers with a credit score under 620, typically considered “high risk”, a new delinquency would drop their scores by about 87 points on average. An extra 87 point drop on top of an already low credit score can make it much more difficult to financially recover in a reasonable amount of time.

There are a few steps which the Department of Education can take to prevent what would essentially be millions of credit profiles dropping overnight. The easiest solution is to extend the reporting pause, which would give borrowers more time to catch up on their student loans. While the overall problem is likely more structural, a pause in reporting for 1-2 years would likely help hundreds of thousands, if not millions of borrowers, in a way that gives them time to plan for the restart in reporting. Limited loan forgiveness, which has already been blocked in the courts, would also give a lifeline to millions of borrowers, though the prospect of that coming back into play is dim at best.

Once the reporting begins again, it’s likely many people are going to be in for a very unpleasant surprise. For borrowers who are at risk of seeing massive credit score drops, the restart in reporting is going to make their lives more difficult. Student loans usually cannot be discharged in bankruptcy and, if they are held by the government, tax returns can be garnished until the loan is paid.